目前大部分国内及香港银行均向港人提供国内楼宇按揭服务,申请手续大致相同,国内银行所提供的按揭成数较低,按揭还款期较短,申请人可按个人情况选择合适计划。

贷款申请所需文件:

- 个人身份证明文件。国内银行要求回乡证、台胞证或护照等,如证件文字为英语,需提供中文翻译本并作公证。入息证明(如近期银行帐户月结单、税单等,视乎个别银行规定,追索时段由6个月至1年不等);

- 住址证明(电、水费单等);

- 物业拥有权证明。一手交易需提供房屋预售合同,二手交易需提供买卖合同及产权证等;

- 部分银行可能会要求申请人提供额外档,如单身/已婚证明文件等。

注意事项:

(1)香港银行

- 对个人住宅物业按揭提供的贷款额,一般可达楼价/物业估值的七成,还款期可长达25至30年;

- 商用物业按揭贷款额则可达物业估值/价值的五成,还款期约为10年;

- 贷款利息以最优惠利率(P)减去银行定值后为准,一般为 P减2.80%至3.10%水准;

- 香港银行罚息期通常涵盖按揭首2至3年。

(2)国内银行

- 由于外地人士不能申请公积金贷款,国内银行一般以商业贷款形式处理外地人士按揭申请,息率较高,贷款额较低。个人住宅物业只提供约五成按揭,还款期最长30年(还款期与申请人当时年龄总和不可超过70年);

- 商业物业按揭额一般不超过四成,还款期约为10年;

- 贷款利息以基准利率(P)折除银行折扣百分比后为准,一般为P乘0.8至0.9水准;

- 国内银行罚息期通常涵盖整个按揭偿还时段。

由于各银行政策及按揭手续不同,以上资讯仅为惯常情况,具体细节应向个别银行核实。

Mortgage

Presently, most banks in China and Hong Kong offer mortgage services for the real estate in China to Hong Kong people. The application procedure is largely the same, with banks in China offering lower loan-to-value ratios and shorter mortgage repayment terms, so applicants can choose a plan that suits their personal circumstances.

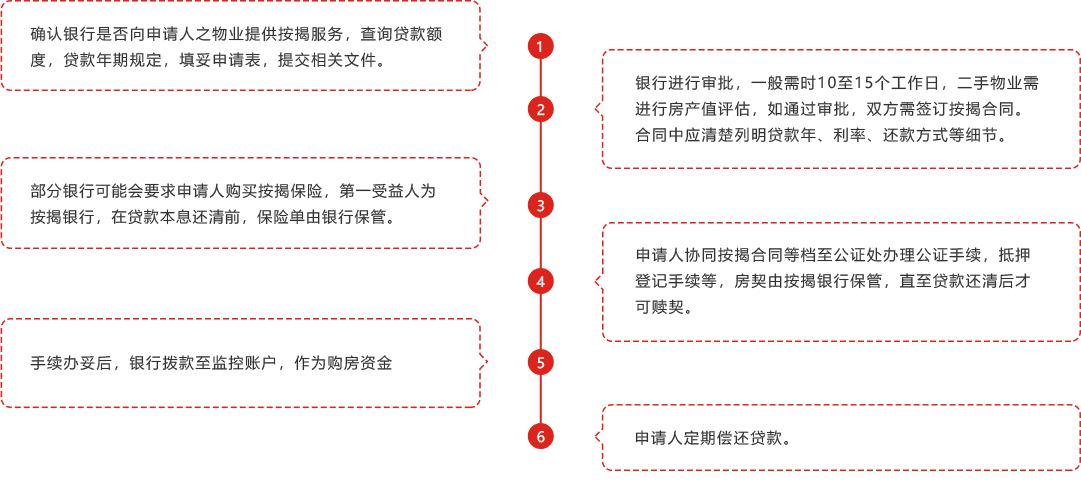

1. Check whether the bank offers mortgage services to the applicant's property, enquire about the loan amount and the loan tenure, complete the application form and submit the relevant documents.

2. It takes 10-15 working days for the bank to process the application to conduct a property value assessment for the second-hand property. If approved, both parties will need to sign a mortgage contract in which the loan year, interest rate, repayment method and other details are clearly stated.

3. Some banks may require the applicant to buy mortgage insurance with the mortgage bank as the first beneficiary. The policy will be held by the bank until the loan principal and interest are fully repaid.

4. The applicant will be required to submit the mortgage deed and other documents to the notary's office for registration of the mortgage. The deed is held by the mortgage bank until the loan is repaid.

5. Once the procedure is completed, the mortgage bank would allocate funds to a monitored account to finance the purchase of the property.

Documents required for loan application

- Proof of identity: Banks in China require Mainland Travel Permit for Hong Kong and Macau, Mainland Travel Permit for Taiwan Residents or passport. If the documents are in English, a Chinese translation must be provided and notarized. Proof of income(recent bank account statements, tax statements, etc.) is subject to a recourse period ranging from 6 months to 1 year, depending on individual bank regulations.

- Proof of address (electricity, water bills, etc.).

- Proof of ownership of the property: A pre-sale contract for first-hand transactions and a sale and purchase contract and title deeds for second-hand transactions.

- Some banks may require additional documents from applicants, such as single status/marriage certificates, etc.

Points to Note:

(1) Banks in Hong Kong

- Residential mortgage plans are generally available up to 70% of the property value/valuation and can be repaid over a period of 25 to 30 years

- Commercial mortgage plans are available up to 50% of the property's value/valuation and can be repaid over period of approximately 10 years.

- The interest rate is based on the prime rate (P) minus the bank's fixed value, which is typically P minus 2.80% to 3.10%.

- The penalty period of prepayment for banks in Hong Kong covers the first 2 to 3 years.

(2) Banks in China

- As foreigners cannot apply for CPF loans, banks in China usually offer commercial loans to them with higher interest rates with lower loan amounts. Residential mortgage plans are available at approximately 50% and can be repaid over a maximum period of 30 years (The sum of the repayment period and the applicant's age at the time cannot exceed 70 years): .

- The amount for commercial mortgage plans is normally no more than 40% and can be repaid over a period of approximately 10 years.

- The interest rate is based on the base rate (P) discounted by the bank's discount percentage, usually at the level of P multiplied by 0.8 to 0.9.

- The penalty period of prepayment for banks in China usually covers the entire period of mortgage repayment.

Due to the differences in bank policies and mortgage procedures, the above information is only general and should be verified with individual banks.